what is a good noi for a rental property

Cap rates are one aspect of any deal. Cap rates are vital and fundamental, but they're only one aspect.

Also, don't forget to consider the cap rate. But also hold time, appreciation and cash flow. All these criteria are important to be aware of as an investor. Understanding these factors will allow you to better determine what capitalization rate you need.

Your investment goals and criteria are another important aspect to be aware of. Knowing your investment criteria and goals will help you determine the best deals for you and your investors.

Cap rates are one aspect of any deal. Cap rates are vital and fundamental, but they're only one aspect.

It is important to remember that assets with stable monthly cash flows do not appreciate much over time. High capitalization rates for the area can generate large cash flows monthly, but they don't appreciate as much over time.

However, a low capitalization ratio typically does not have a high monthly cashflow. In most cases, however, the capitalization rate will appreciate over time.

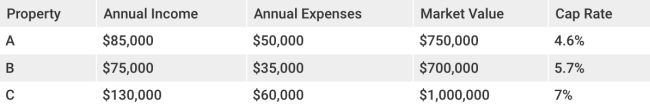

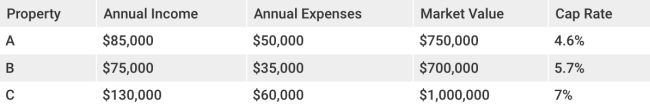

The capitalization rate shows investors how long it takes to recover their investment. Divide the NOI and the purchase price to calculate a property's capitalization rate.

These are the only variables that determine the cap rate. You should also consider price and income when entering into a deal.